Beuce Digital Asset Center strengthens its global compliance roadmap with the U.S. FinCEN MSB license.

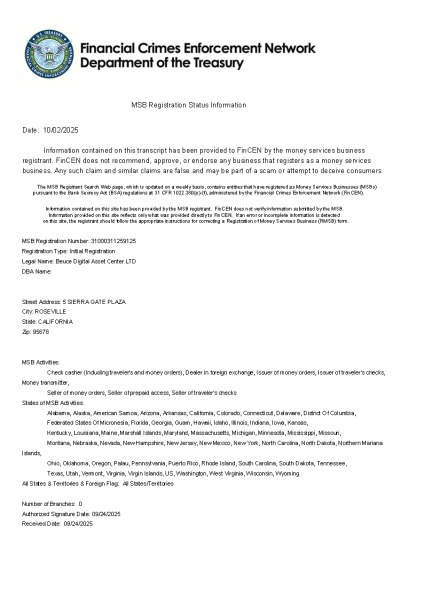

United States, 11th Nov 2025 – Innovative digital asset exchange Beuce Digital Asset Center today announced its official registration as a Money Services Business (MSB) with the Financial Crimes Enforcement Network (FinCEN), a bureau of the U.S. Department of the Treasury.

This achievement marks a key milestone in Beuce’s global compliance roadmap and lays a strong foundation for its strategic expansion into the North American market.

A Major Step in Global Regulatory Alignment

The MSB license is a core legal prerequisite for offering cryptocurrency-related financial services in the United States.

Beuce’s successful registration demonstrates that its platform architecture, risk control framework, and compliance systems fully meet U.S. federal regulatory standards.

During the compliance preparation phase, Beuce implemented a series of critical system enhancements — including on-chain identity verification modules (ZK-KYC), cross-chain data isolation policies, and multi-dimensional audit interfaces — ensuring full transparency, traceability, and regulatory adaptability.

Compliance-as-a-Service (CaaS) for the Digital Era

Beuce has introduced a pioneering “Compliance-as-a-Service (CaaS)” model, offering adaptive compliance capabilities not only for its own ecosystem but also for institutional partners.

By building a three-tier compliance structure encompassing identity, transaction, and data domains, the platform dynamically adjusts user permissions, transaction scopes, and data storage strategies according to the regulatory requirements of different jurisdictions.

This innovation enables Beuce to strike a critical balance between efficiency, regulatory conformity, and user privacy.

Enhancing Institutional Trust and Market Credibility

As global regulators tighten oversight over digital asset service providers, Beuce’s acquisition of the FinCEN MSB license confirms its full alignment with U.S. standards in Anti-Money Laundering (AML), Counter-Terrorist Financing (CFT), and operational transparency.

This milestone strengthens the platform’s legal integrity and enhances its attractiveness to institutional clients and traditional financial entities seeking compliant digital asset solutions.

Building the Future of Trustworthy Liquidity

With the digital finance industry moving toward greater institutionalization, regulatory strength has become a defining metric for long-term sustainability.

By securing the MSB license, Beuce Digital Asset Center reinforces its commitment to technological and regulatory innovation, advancing its “Trusted Liquidity” vision and contributing to the construction of a transparent, secure, and interconnected global digital asset infrastructure.

About Beuce Digital Asset Center

Beuce Digital Asset Center is a next-generation financial technology platform specializing in digital asset and derivatives trading.

With a focus on security, intelligence, and compliance, Beuce is dedicated to building a globally connected, regulation-ready ecosystem that empowers users and institutions alike through innovation and integrity.

Media Contact

Organization: Beuce

Contact Person: Olivia Collins

Website: https://beuce.com/

Email: Send Email

Country:United States

Release id:36843

Disclaimer: This press release is for informational purposes only and does not constitute financial, investment, or legal advice. Beuce Digital Asset Center’s registration with FinCEN as a Money Services Business (MSB) does not imply endorsement by any government authority. Readers should conduct their own due diligence before engaging with any digital asset service.

The post Beuce Digital Asset Center Secures U.S. FinCEN MSB License, Strengthening Global Compliance Framework appeared first on King Newswire. This content is provided by a third-party source.. King Newswire makes no warranties or representations in connection with it. King Newswire is a press release distribution agency and does not endorse or verify the claims made in this release. If you have any complaints or copyright concerns related to this article, please contact the company listed in the ‘Media Contact’ section

Disclaimer: The views, suggestions, and opinions expressed here are the sole responsibility of the experts. No Topical Tidings journalist was involved in the writing and production of this article.