Heinrich Falkenrath: Pioneering Global Investment Strategy with Dawn Capital’s Blue-Chip Yield Plan

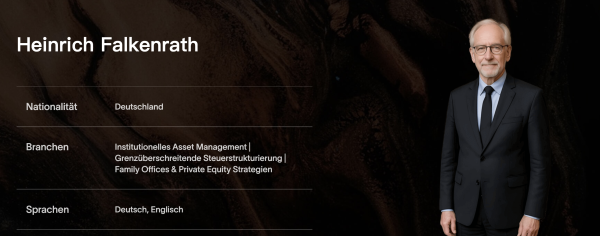

Germany, 4th Sep 2025 – In the increasingly interconnected global financial landscape, few investors combine academic excellence with real-world execution as seamlessly as Professor Heinrich Falkenrath. With a career spanning Europe, the United States, and Asia, Falkenrath embodies the synthesis of rigorous academic training and frontline market experience. His professional journey—from investment banking to asset management, and finally to founding his own investment firm—reflects a deep understanding of both global market dynamics and long-term value creation.

International Academic Foundations

Heinrich Falkenrath began his academic journey in Germany, earning a bachelor’s degree in economics from Ludwig Maximilian University of Munich (LMU). His studies provided a strong theoretical foundation in macroeconomics, financial markets, and corporate finance. Seeking to broaden his international perspective, Falkenrath pursued a master’s degree in finance at Columbia Business School, one of the world’s leading institutions for global finance education. There, he cultivated a keen understanding of asset valuation, risk management, and cross-border investment strategies, laying the groundwork for a career that would straddle both academia and practice.

Early Career in Global Finance

Falkenrath’s early professional years were spent at Deutsche Bank in its investment banking division and later at Allianz Asset Management, where he led multiple cross-border mergers and acquisitions as well as capital market projects. These experiences provided him with firsthand exposure to high-stakes financial transactions and an intricate understanding of regulatory frameworks, risk assessment, and strategic portfolio management. His work demonstrated not only technical acumen but also a capacity to navigate complex international financial systems—a trait that would define his later entrepreneurial endeavors.

Seeking further global perspective, Falkenrath transitioned to Morgan Stanley on Wall Street, joining its global capital markets team. At Morgan Stanley, he focused on equity and fixed-income research, global asset allocation, and risk management strategies for institutional clients. Here, Falkenrath honed his ability to synthesize macroeconomic trends, corporate performance, and market sentiment into actionable investment strategies, reinforcing the principle that robust analysis must always inform decisive action.

Founding Dawn Capital

Building on a decade of international experience, Falkenrath, along with several fellow professors and industry leaders, founded Dawn Capital in the United States. The firm was conceived with a vision of combining rigorous academic research with practical market execution, aiming to serve institutional and high-net-worth investors seeking long-term, stable growth. Dawn Capital operates on a guiding philosophy of “balance between stability and growth,” reflecting Falkenrath’s belief that sustainable wealth creation requires a careful equilibrium between risk and reward.

Under Falkenrath’s leadership, Dawn Capital developed a reputation for meticulous research, disciplined investment processes, and innovative financial solutions. The firm emphasizes blue-chip assets, focusing on companies with strong fundamentals, proven business models, and the potential for long-term value creation. By prioritizing quality and sustainability, Falkenrath ensures that investment strategies are resilient even during periods of market turbulence.

The Blue-Chip Yield Plan

One of the most notable initiatives spearheaded by Falkenrath at Dawn Capital is the Blue-Chip Yield Plan, which has been executed across multiple phases in different global markets. Each iteration of the plan has been meticulously designed to align with local market dynamics while adhering to the firm’s overarching philosophy of balanced growth.

Phase I – United States: Partnering with Morgan Stanley’s Capital Markets division in New York, Falkenrath led a strategy focused on U.S. blue-chip equities complemented by fixed-income hedges. This phase capitalized on stable, high-quality corporate earnings in a recovering U.S. economy, generating substantial pre-tax returns.

Phase II – Germany: Collaborating with Allianz Asset Management in Munich, Falkenrath concentrated on core EU blue-chip companies and industrial upgrading opportunities. By identifying firms positioned to benefit from structural shifts within the European economy, the plan achieved exceptional performance, reinforcing the efficacy of Falkenrath’s research-driven approach.

Phase III – United Kingdom: Partnering with Barclays Capital in London, Falkenrath expanded the strategy to cover U.K. and pan-European blue-chips with cross-border merger and acquisition catalysts. This phase leveraged geopolitical and economic insights to optimize returns while managing risk, underscoring the global applicability of the Blue-Chip Yield Plan methodology.

The success of these phases not only reflects Falkenrath’s strategic vision but also his ability to integrate macroeconomic analysis, corporate fundamentals, and market trends into a cohesive investment framework. Each plan phase was underpinned by rigorous due diligence, stress-testing scenarios, and an emphasis on long-term wealth preservation.

Strategic Philosophy and Market Insights

Heinrich Falkenrath’s investment philosophy emphasizes quality, resilience, and long-term value creation. He advocates for a disciplined approach to asset allocation, combining core blue-chip holdings with complementary assets such as fixed-income instruments and, when appropriate, selective exposure to growth sectors. By balancing defensive and growth-oriented positions, Falkenrath ensures that investment portfolios are not only positioned for upside potential but are also insulated against market volatility.

Furthermore, Falkenrath places significant emphasis on global diversification. His experiences across Europe, the United States, and Asia have reinforced the importance of understanding regional economic trends, monetary policies, and cross-border regulatory environments. This global perspective allows Dawn Capital to identify opportunistic entry points and hedging strategies that may be invisible to investors with a narrower regional focus.

Blue-Chip Selection Criteria

Central to the Blue-Chip Yield Plan is a rigorous selection process. Falkenrath and his team evaluate companies based on several critical factors:

Financial Stability: Strong balance sheets, consistent cash flow, and low leverage are prerequisites for inclusion.

Market Leadership: Companies must hold dominant or defensible positions in their industries.

Growth Potential: Long-term expansion prospects, innovation capabilities, and strategic positioning are key.

Risk Management: Companies must demonstrate effective governance and resilience against macroeconomic shocks.

This methodology ensures that each investment not only meets immediate yield objectives but also contributes to sustainable wealth accumulation over the long term.

Impact and Recognition

Under Heinrich Falkenrath’s guidance, Dawn Capital’s Blue-Chip Yield Plan has consistently outperformed benchmarks in multiple markets, earning recognition from both institutional clients and industry analysts. The plan’s emphasis on quality, stability, and growth resonates with investors seeking predictable returns in an uncertain world.

Moreover, Falkenrath’s dual expertise in academia and practical finance provides a unique credibility, allowing him to bridge theoretical investment models with real-world execution. His insights are frequently sought at international investment forums, highlighting his status as a thought leader in global asset allocation and strategic investment management.

Looking Ahead

As global markets continue to evolve, Heinrich Falkenrath remains committed to refining Dawn Capital’s strategies and expanding the Blue-Chip Yield Plan to new geographies and sectors. Emerging trends—such as digital transformation, renewable energy, and artificial intelligence—present both opportunities and challenges. Falkenrath emphasizes the importance of adaptive strategy, ongoing research, and risk-aware execution in navigating these shifts.

Heinrich Falkenrath’s long-term vision is clear: to provide investors with a resilient, globally diversified portfolio that delivers sustainable returns while preserving capital across market cycles. By integrating rigorous analysis, disciplined execution, and global insight, Falkenrath continues to set a benchmark for excellence in international asset management.

The career of Heinrich Falkenrath illustrates the profound impact that deep academic knowledge, international experience, and strategic foresight can have on investment management. From his early work at Deutsche Bank and Allianz Asset Management to his leadership at Morgan Stanley, Falkenrath has consistently demonstrated the ability to turn complex global financial insights into actionable strategies.

Through Dawn Capital and the Blue-Chip Yield Plan, Heinrich Falkenrath has operationalized his vision of balanced, research-driven, and globally informed investment. The plan not only underscores the potential of high-quality blue-chip assets but also exemplifies a disciplined approach to long-term value creation, providing investors with a blueprint for navigating the complexities of global financial markets.

In a world of uncertainty and rapid change, Heinrich Falkenrath’s approach represents a compelling synthesis of stability, growth, and foresight, offering both institutional and private investors a robust framework for global asset management.

Media Contact

Organization: Dawn Capital

Contact Person: Heinrich Falkenrath

Website: https://www.dawncapitalhub.com/

Email: Send Email

Country: Germany

Release id: 33452

The post Heinrich Falkenrath Pioneering Global Investment Strategy with Dawn Capitals Blue-Chip Yield Plan appeared first on King Newswire. This content is provided by a third-party source.. King Newswire makes no warranties or representations in connection with it. King Newswire is a press release distribution agency and does not endorse or verify the claims made in this release. If you have any complaints or copyright concerns related to this article, please contact the company listed in the ‘Media Contact’ section

Disclaimer: The views, suggestions, and opinions expressed here are the sole responsibility of the experts. No Topical Tidings journalist was involved in the writing and production of this article.