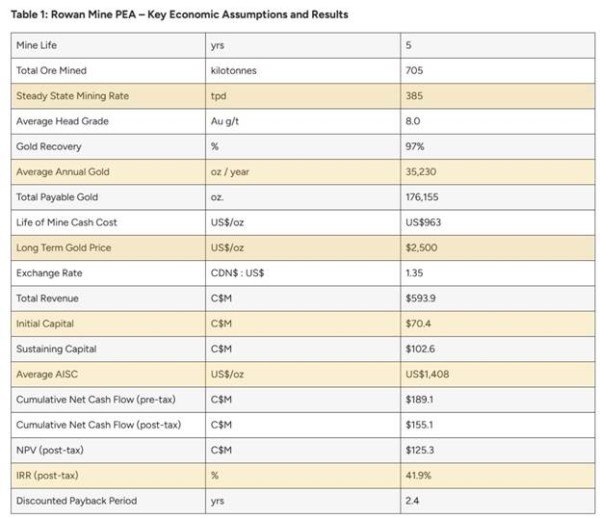

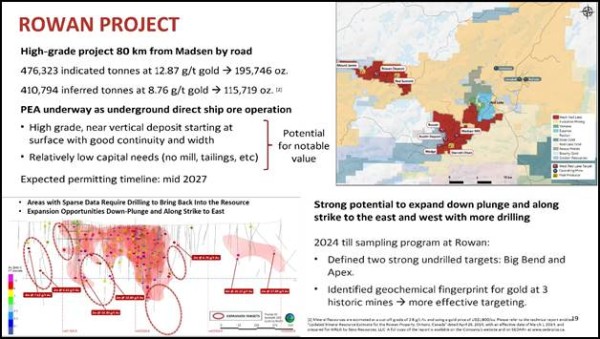

The Rowan Project is 80 kilometers by road from the operating Madsen Mine and mill. Rowan is a high-grade, relatively wide, nearly vertical deposit that starts at surface. The PEA projects a US$1,408/oz all-in sustaining cost (AISC).

Vancouver, BC, July 10, 2025 – Global Stocks News – Sponsored content disseminated on behalf of West Red Lake Gold. On July 8, 2025, West Red Lake Gold Mines (TSXV: WRLG) (OTCQB: WRLGF) published the results of a Preliminary Economic Assessment (PEA) at its 100%-owned Rowan project in the Red Lake Gold District of northwestern Ontario, Canada.

The Rowan Project is 80 kilometers by road from the operating Madsen Mine and mill.

“Rowan is a high-grade, relatively wide, nearly vertical deposit that starts at surface, and this PEA captures how such designed-for-mining characteristics lead to strong economics,” confirmed Shane Williams, WRLG President and CEO, in the July 8, 2025 press release.

Rowan Select PEA Highlights:

- High-Grade Efficient Mine: Average diluted head grade of 8.0 grams per tonne.

- Notable Production: 35,230 oz. average annual gold production over the 5-year mine life from an average mining rate of 385 tonnes per day.

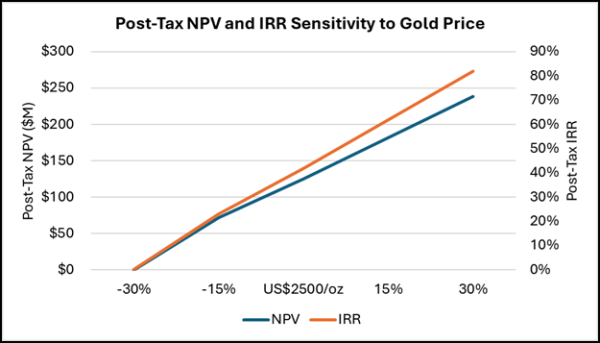

- Strong Value: Post-tax NPV rises to $239M at US$3,250 per oz gold.

- Low Costs: US$1,408/oz all-in sustaining cost (AISC).

- Strong Returns: IRR of 81.7% at a US$3,250/oz gold price.

- High Confidence Inventory: PEA mine design includes 63% of mined tonnes and 72% of mined ounces from the Indicated category.

- Simple Metallurgy: Free gold-dominant mineralization resulting in 75.8% to 94.9% gold recovery through gravity processing.

- Modest Initial Capital: Opportunity to develop Rowan as a toll milling operation with initial capital of just over $70 million.

Multiple mills in the Red Lake area have excess capacity and are designed to process mineralization of a similar nature to the deposit at Rowan. West Red Lake Gold is planning Rowan as a mine that sends its material to another mill for processing. The toll milling plan eliminates the need for a mill and an on-site tailings facility at Rowan.

Madsen is one mill in the region that could potentially take Rowan mineralization. The Madsen Mill has a nameplate capacity at 1,089 tonnes per day (tpd), and is currently permitted to run at 800 tpd average annually. It ran as high as 1,200 tpd in 2022, under the prior operator.

Further PEA Highlights:

Development and Permitting Timeline: WRLG plans to complete a Pre-Feasibility Study (PFS) on the Rowan Project by Q3 2026. New Bill 5 legislation in Ontario aims to expedite the mine approval process.

Significant Exploration and Growth Potential: There are multiple opportunities to define additional mineralization at Rowan by:

- Expansion drilling on the two main veins of the deposit included in this PEA mine plan (v001 and v004), especially at depth.

- Infill and expansion drilling on parallel veins adjacent to the PEA mine plan, with data gaps stemming from selective historic drill sampling.

- Drill testing expansion targets along strike from the Rowan vein system.

- Testing high-potential new targets at the property, including Apex and Big Bend.

“There is ample opportunity to grow the resource further at Rowan along strike, at depth, and via discovery at new nearby targets, but we ideally want to do that work while turning this asset into a mine sending high-grade mineralization to an operating mill in the area and potentially generating significant revenue for the Company,” stated Williams.

During the 2023 drill campaign, West Red Lake Gold demonstrated that gold mineralization regularly persists into the altered wall rock adjacent to high-grade gold veins. Historic operators only sampled the parts of the drill core that appeared mineralized. This selective sampling would have missed visually subtle mineralization. It is likely that ‘halo’ mineralization of this nature could add enough scale to parallel veins to pull those areas into mine planning consideration.

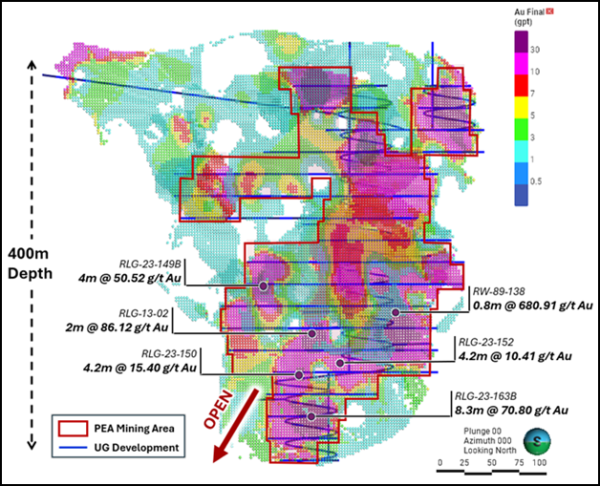

The next layer of opportunity at Rowan is based on expanding the deposit. The 2023 drill campaign included hole RLG-23-163B, which returned 70.8 g/t gold over 8.3 metres.

This intercept indicates potential for mineralization to continue, and perhaps strengthen, at depth. The Rowan vein system has only been defined down to approximately 400 metres and remains wide open for expansion at depth (Figure 2). The Rowan deposit also remains open along strike to the east and west.

Figure 2. Long section of Rowan block model at 1 gpt Au cutoff showing PEA mine design (blue) and outline of areas planned for long hole stoping (red outline). Notable assay intercepts have been highlighted to indicate the strength of gold mineralization and expansion potential at depth.

“A NPV of $239 million at close-to-spot gold pricing provides a compelling case to advance Rowan swiftly from here,” stated Williams. “We plan to advance engineering work while completing a drill program to infill gaps that prevented parts of the resource from being considered in the mine plan and upgrade roughly 37% of the mine plan tonnes that currently sits within the inferred resource category.”

The PEA is preliminary in nature, includes inferred mineral resources that are considered too speculative geologically to have the economic considerations applied to them that would enable them to be categorized as mineral reserves, and there is no certainty that the PEA will be realized.

For the last 18 months, WRLG has been focused on putting the Madsen Mine back in production. The July 8, 2025 Rowan PEA announcement, and page 19 of WRLG’s current deck confirm that Rowan remains an important part of the West Red Lake Gold master plan.

The technical information presented in this news release has been reviewed and approved by Will Robinson, P.Geo., Vice President of Exploration for West Red Lake Gold and the Qualified Person for technical disclosure at the West Red Lake Project, as defined by NI 43-101 “Standards of Disclosure for Mineral Projects”.

Contact: guy.bennett@globalstocksnews.com

Disclaimer: West Red Lake Gold paid Global Stocks News (GSN) $1,750 for the research, writing and dissemination of this content.

References:

1. Please refer to the technical report entitled “NI 43-101 Technical Report and Prefeasibility Study for the Madsen Mine, Ontario, Canada”, prepared by SRK Consulting (Canada) Inc. and dated January 7, 2025. A full copy of the SRK report is available on the Company’s website and on SEDAR+ at www.sedarplus.ca.

2. See PFS Section 16.5.3 Mining Methods – Underground Mining Methods – Planned Mining Methods.

Additional References:

3. See PFS Report Section 21.3.2 Capital and Operating Costs – Operating Cost Estimates – Mining.

4. Mineral reserve estimates based on a gold price of US$1,680/oz and an exchange rate of 1.31 C$/US$. Longhole stope cut-off grade of 4.30 gpt Au based on an estimated operating cost of C$287.34/t including mining, plant and G&A. Mechanized Cut and Fill stope cut-off grade of 5.28 gpt Au based on an estimated operating cost of C$354.90/t including mining, plant and G&A. Incremental development cut-off grade of 1 gpt Au. A small amount of incremental longhole tonnes were included at a cut-off grade of not less than 3.4 gpt Au, these must be immediately adjacent to economic stopes that will pay for the capital to access area.

5. Mineral resources are estimated at a cut-off grade of 3.38 g/t Au and a gold price of US$1,800/oz. Mineral resources are not considered mineral reserves as they have not demonstrated economic viability.

6. See Section 24.1 Other Relevant Data – Gold Price Sensitivity.

Media Contact

Organization: Global Stocks News

Contact Person: guy.bennett@globalstocksnews.com

Website: https://www.globalstocksnews.com

Email: Send Email

Country:Canada

Release id:30468

The post West Red Lake Golds Rowan PEA Projects Average Annual Production of 35000 ounces at 8 grams per tonne AISC of US$1408 per ounce appeared first on King Newswire. This content is provided by a third-party source.. King Newswire makes no warranties or representations in connection with it. King Newswire is a press release distribution agency and does not endorse or verify the claims made in this release. If you have any complaints or copyright concerns related to this article, please contact the company listed in the ‘Media Contact’ section

Disclaimer: The views, suggestions, and opinions expressed here are the sole responsibility of the experts. No Topical Tidings journalist was involved in the writing and production of this article.